Pull the trigger

This is a follow-up post. If you haven't read my last post, I encourage you to do so to get the context. Not only is the financial aspect a significant factor when not expressing selectivity in investments, but the mental one as well.

Stanley Druckenmiller was 26 when he was a banking and chemical analyst. He was promoted to director of research, where around 8 guys and his old boss, who was 52, would start reporting to him. He thought he was pretty good at what he was doing, but his boss told him why he did that: 'Because for the same reason they send 18-year-olds to war. You are too dumb, too young, and too inexperienced not to know to charge. We around here have been in a bear market since 1968. I think a big secular bull market is coming. We have all got scars. We are not going to be able to pull the trigger. So I need a young inexperienced guy. But I think you have got the magic to go in there and lead the charge.' This was in 1978. Shortly after, the Shah of Iran fell, and he bought 70% oil stocks and 30% defense stocks, selling all of the firm's bonds. The portfolio went up 100% while the S&P stayed flat. When he made the investment, all the more experienced portfolio managers called him crazy, and he himself, in retrospect, said that if he had had a bit more experience, he would have thought it would be crazy too. 'It was my youth, and it was my inexperience, and I was ready to charge.'"

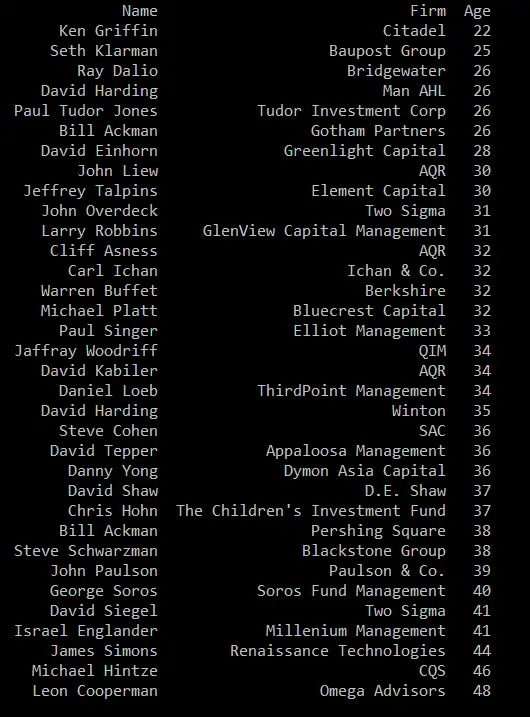

Something I want to add here is that it isn't about being reckless in your investments; it's about finding the balance between a rational mind, lack of biases, and experience, which is hard to fathom. Yesterday, I saw a discussion on Twitter about the perfect age to start a fund. The arguments were always between starting in the mid-20s, where you still have the drive and lack biases but lack experience, or at 40 or higher, where it's the other way around. It's a tradeoff.

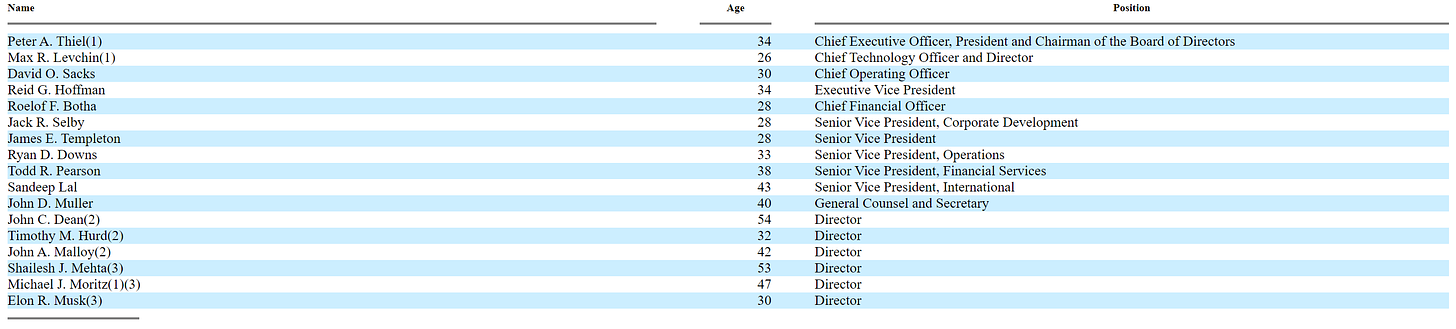

Median age of Paypal executive at the S-1 of the IPO was 30

Thanks,

Finn